That’s Delivered Podcast

Welcome to “That’s Delivered Podcast” (TDP) your ultimate destination for all things trucking and beyond! Here, we take you behind the wheel and dive deep into the world of trucking, delivering stories, insights, and experiences designed to inspire, educate, and entertain.

Our podcast isn’t just about transportation; it’s about reliability, accomplishment, and fulfillment. “That’s Delivered Podcast” reflects the sense of completion that comes with meeting promises and exceeding expectations, whether on the road or in life.

Whether you’re a seasoned trucker, a logistics enthusiast, or just curious about the backbone of our economy, this is the place for you. We’ll explore life on the road, uncover how technology is reshaping the industry, and break down the latest regulations impacting drivers and businesses alike.

So buckle up, hit the road with us, and join a community that understands the journey is just as important as the destination. From personal stories to industry insights, “That’s Delivered Podcast” brings the best of trucking straight to your ears, promising every mile together will be worth the ride!

That’s Delivered Podcast

How Matt Putra helps Trucking Companies Build Profits, Manage Cash Gaps, and Scale with Confidence

Use Left/Right to seek, Home/End to jump to start or end. Hold shift to jump forward or backward.

In this actionable episode, CFO and operator Matt Putra, CEO of Eightx, transforms the trucking industry’s toughest financial challenges into a clear, practical playbook you can implement this month. Specializing in fractional CFO services for eCommerce, CPG, and growth-stage companies, Matt draws from his expertise in cash flow optimization, margin improvements, and team alignment to help fleets scale with more cash and less stress. From navigating cash flow gaps caused by slow AR payments to managing urgent fuel and payroll demands, he shares strategies like 12-month forecasting and 16-week cash views to keep your fleet running smoothly. With a focus on real-world solutions, he demystifies contribution margin, guides you through scenario planning for diesel spikes or expansion, and reveals how to prioritize costs and leverage AI to stay ahead. This episode is a must-listen for owner-operators ready to stop guessing and start scaling with confidence.

Key Takeaways 👇

✅ Mastering Cash Flow: Tackle the cash gap from 30–60 day AR delays against urgent fuel and payroll needs using a 12-month forecast paired with a 16-week cash view to keep trucks rolling and stress low.

✅ Contribution Margin Clarity: Matt explains contribution margin in plain English, helping you determine if each load boosts profits or erodes your bottom line.

✅ Scenario Planning for Resilience: Learn to stress-test your finances for diesel price spikes, slower growth, or new lane expansions to make informed decisions about truck purchases or subcontracting.

✅ Smart Expansion Strategies: Discover why new trucks can hurt margins, when subcontracting makes sense, and how to scale from two to ten trucks without risking your bank balance.

✅ Cost Triage Tactics: Prioritize revenue-generating roles, protect KTLO (keep the lights on) expenses, and cut non-essential costs to ensure your fleet survives and thrives.

✅ People and Tech Advantage: Hire drivers who build customer relationships for repeat business, and use AI to summarize calls, flag issues, draft outreach, and chase invoices for faster, smarter decisions.

✅ Take Action Now: Hit play to start growing intentionally, share with a fellow owner-operator, and test your first financial scenario—then let us know what money problem to tackle next.

Interested in being a guest on the podcast? Click here to join the conversation!

Built for drivers. Powered by grit.

Bold, smooth, and crafted for the long haul 3-Axle Coffee keeps America moving, one cup at a time. Whether you’re hitting the road or hitting deadlines, this is the brew that never brakes.

Strong. Steady. 3-Axle Ready.

Try it now at 3AxleCoffee.com

Welcome back to Das Delivered Podcast. I'm your host, Trucking Ray, and today we're talking money, the kind of money where decisions can make or break a trucking company. Our guest is Matt Petruer, has helped six figures losses turn into seven-figure profits and scale businesses past 100 million. He's worked with e-commerce and CPG brands, and he's also had lessons where he brings cash flow, growth, and strategy to hit home for anyone who runs trucks, build fleets, and keep the lights on. Trucking is an industry where too many run on gut instinct. But Matt's here to show us how we can replace gut calls with financial clarity so we can scale with confidence. Thanks so much for having me, Ray. Good to see you. Awesome. And we got a lot to talk about. We can cover is your journey and your perspective of what's going on in the industry. You worked in environments where you've made decisions backed by data and big money. What was the aha moment when you realized uh smaller owner-led businesses like trucking companies needed the same financial discipline?

SPEAKER_02:Um Yeah. So I used to be a CFO of a private equity group. And the aha moment for me came when a really good friend of mine asked for help with his small business, him and his wife. And they was just like three of them. And they asked for some help. And I built them a financial same things I would do for any other company. I built a financial forecast, I made some scenarios, did some reporting, and we just found out that that intelligence helped them make better decisions. And that year, we actually saved$50,000 that they would otherwise have spent on actually on shipping, um, shipping over the ocean. And I said, hey, well, why don't you try shipping on the sea? You but pay for it a little bit earlier. And anyway, they saved a whole bunch of money. Um, and so that's when I realized that like any business can can benefit from like strong finance.

SPEAKER_00:Nice. I it makes perfect sense. I mean, I think a lot of trucking companies often start as family operated operations. Um, how have you convinced owner operators or uh businesses from doing things their way over 20 years or more financial structure? It's just important to get things, you know, as getting freight delivered on time. Mm-hmm.

SPEAKER_02:Um, you know, I don't know that I'm like convincing people per se, but I think when when I meet someone who's frustrated with their results, or I meet someone who who kind of wonders if there's more or wants to grow or wants to turn their business around, I think that kind of person kind of vibes with what I do. And and then when I say, well, you know, what what keeps you up at night? And they say, Oh man, I just don't know if I can, if I got payroll covered for three months, I'm like, ah, okay, there we go. And they're like, oh, I wish I'd have no idea how my business is really doing. And I say, okay, so so then I go, well, what if I gave you a report that told you exactly how you did the last three months or one month? And then what if I tell you that we can look over the next six months and make some plans, and those plans will hold up even if something bad happens or something good happens, and they go, Oh, well, that could work. And I go, Well, yeah, that's what we do, right? So so it tends to be somebody who's ambitious. Um, I can't convince somebody who doesn't really want it, you know.

unknown:Yeah.

SPEAKER_00:Absolutely. I mean, uh, when we try to convince people, sometimes it comes across too salesy. So uh just helping people, just being there for them is a huge thing to to be able to be in that position to do that. So you're in a position to help people financially, I think that's a really great place to be. Um, maybe people can feel vulnerable. Um, you know, got their stuff out there. Hey, I don't want to talk about it, but this is where I need help, you know. So good job. 100%. Yeah, and so as far as finance and trucking um realities and trucking cash can often, you know, be 30 to 60 days after the load is delivered. But expenses, fuel repair, payroll, and they're all due daily or weekly. What strategies do you recommend to manage that constant mismatch? Yeah.

SPEAKER_02:Well, um, I think that's one of these businesses where you can't actually grow too fast, right? So if you grow too fast, you actually run out of money. And so the the big thing that I like to do in these situations where there's like delays between expenses and receiving your money back, the most important one that I'll do is cash flow planning and scenario planning, meaning we'll sort of make a budget for a year, and let's say they think maybe we'll grow 20% this year. So we'll make a plan, and we'll go, we're gonna buy this truck or hire these people or pay this much in fuel, and this is when it's due. And then what we do is we say, what if we do all the things and we only grow 10%? Or what if we do all the things and we grow 40%? Where does the breakage occur? And and what we're looking for is sort of breakage in margins or cash flow or just net profit. And when you kind of uh play with the scenario like that, it shows you which one of those things will break first. And then what we do is we've we look where the breakage occurs, what month or or when could it happen? And then we make we kind of dive even deeper on the planning. So then we might do instead of a monthly, we might do a weekly forecast. And we might say um for the next 16 weeks, what do things look like? Um, and so that's that's the foundation of it all. And then there are strategies, of course. Um, sometimes you can factor your your receivables. So someone will give you the money up front and then they'll collect the money from your customer, they'll take 2% or something like that. So we don't want to do that if we don't have to. We can. Um otherwise, we can offer early payment discounts to people. They don't always take them, but sometimes they will. Um, and then good old-fashioned follow-up, right? So you email them five days before the invoice is due, you email them the day the invoice is due, five days after, then you call, then you you know, you do all these things, then you show up, you know. Um, those are things that accelerate payment timelines, and you don't have to be heavy-handed. Um, but and sometimes though, it's just the way that it goes. And so you have to make sure you don't grow too fast and make sure that you have sometimes you have better margins than others might if you want to be comfortable in that position. For those that are comfortable being uncomfortable, you can grow fat or kind of white knuckle it. But you know, those are some of the things I would do.

SPEAKER_00:Yeah, it kind of sounds like driving. You know, you can do the speed limit and get there when you're supposed to, or you could try to push it real hard to get there, and then you get you know, more risk involved, and you can actually may not even make it there. So speed is definitely something a trucker knows. So financially, it's probably the same. You said about uh you mentioned braking. How do you find those brakes um where those vulnerabilities are financially?

SPEAKER_02:Yeah. Like I say, the first thing that we do for anybody when we work together is we make a budget, essentially, right? So the next 12 months, what does it look like? And we obviously base that off of what have things been looking like with the last three to six months, how are those looking? And then we just make a plan. So we say you've been growing whatever, 10% per year or 5% a month, whatever you've been growing at. Let's add those deliveries. And what is the capacity of the trucks for deliveries today and the people? And then what we do is we set up a financial forecast that the the next delivery that happens over and above the ones that the truck has available, it'll add another truck in the model. Okay, or we can choose to contract subcontract. So we would do one of those two things. And when we do that, the model begins to be useful because it will know when you've hit that step change in delivery, you need a new truck or subcontract. So your margins will drop, or they'll stay the same, but you'll have a cash outflow or a new loan or financing or some purchase, right? And and the way and the reason we do that is because you know we can never really know what's going to happen, but we can make assumptions. So we make all these assumptions for the next 12 months, and then like I say, we just test them. So you you open it up and you go, okay, to the owner operator or the family, you say, Does this look how does it look to you? And really you go off gut feel, right? Because you just don't know. And so then we get it to a point where it looks good. Then we say, Great, that's our best guess, right? That's what we think is gonna happen. Then we do one where I cut some growth off. And we go, based if we cut some growth off, do we still look okay? Is margins okay? Have we hired too much? Uh, you know, is the how's cash flow looking? And then we might ratchet up gas prices or diesel prices, see what that how that changes our forecasts. And we do that based off of historical diesel prices, where they are today. We look at economic economists, economist forecasts. Um, we can look at that. And then we go, what if we add more growth? Because sometimes more growth can be harder than the same level of like stability. So we go, okay, that grows, great. Do we buy trucks? Do we subcontract? How does diesel prices look? And we test a bunch of things, and then between those three scenarios, we have a one we think is going to happen, we have a bad one, we have a good one. Typically, what you'll see is cash flow will have an issue or margin will have an issue, and we find out where the issue is. So let's say, for example, you grow too fast and it triggers the purchase of a new truck, and you say, ah shit, I don't have a down payment for that, or whatever. So we say, Great, well, now we know that six months in advance. So let's go find some subcontractors that can do some stuff for us, and we'll make an agreement with them that, you know, this agreement or that agreement. So then we'll subcontract for six months, then we'll buy a truck, let's say, as an example. So that's some of the ways that we do this. We all we just look at scenarios. What could happen if this, what could happen if that? We just test monthly. Um, and typically the goal is to find a problem nine months before it occurs. If we do that, we give people time to fix it before it even happens.

SPEAKER_00:So it's real reality, real thinking, and real time. Um, I like the way you guys do that. Uh is it something you were always good at with numbers, or you just got a great team? Uh, what really makes the magic work for you guys, man? It sounds like you uh got it dialed in.

SPEAKER_02:Yeah, I mean, I came to it later in life. I was uh I worked in manufacturing for the first eight years, like from 19 to like 27, and then I worked at a at a machine shop for a while. And at the machine shop, what happened was I was the quality manager there and and I had to do some stuff with like what if we have this many units and that many units, and what happens to production? And I got into spreadsheets there, ended up being really good at it, uh, and then I went into accounting in finance. And so after that, I only became a CFO when I was 32. Um, so um, but I was awesome at it, basically, right? Like, and I worked in private equity and I did deals, and we we did like half a billion in deals uh with the time that I was there. So yeah, I was really good at it, but I didn't find out till later in life. And then, like I say, my buddy called me and we did this for him, and I did it for his buddy and their buddy, and you know, my business gets kind of took off organically from there.

SPEAKER_00:Nice. Yeah, I mean that's cool when you got friends that trust you and because trust is a factor when it comes to people's money and finances. Uh you don't want to just throw those around to anybody. So 100%. Man, so if uh if a trucking company is is running at break-even or at a small loss, where should they look first to identify what's really eating away at their profit?

SPEAKER_02:I'll give you what I would do for almost anybody, I would say, and that is the first place you look is something called contribution margin. Now I don't know, actually, I'm not sure if that term is familiar in trucking, but it's a useful term, so I'll break it down. Contribution margin is net revenue. So revenue minus discounting or returns, not do you have returns, but rebates or promos or whatever. So net revenue, right? Then you go less your variable costs. This is gonna be fuel uh and any variable cost. Uh let's say it's gonna be like some uh repairs or maybe tires or brakes, things like that, like they that are that are the more you drive, the more cost you have. So fuel, uh variable cost, and so when you remove the variable cost of supplying the service, all the variable costs, you end up with a contribution margin. So there's probably some hourly drivers, there might be subcontracts, there might be owner operators. Um, and so anyway, as long as it's variable, you reduce your net revenue by everything that's variable, like everything. And when you want to identify variable costs, the way that those work is if you drive more or you do more deliveries, this cost also goes up. Doesn't have to be at the same rate, but if it changes if you drive more, or if it stops if you drive less or slows down if you drive less, it's variable. So you do net revenue minus all your variable costs, contribution margin. What that means is from a dollar of revenue, how many cents do you get to keep to cover your fixed costs, like your admin or your office or leases and things like that? You know, those aren't gonna change if you drive more or less. So, how many cents? So, from a dollar of revenue, how many cents do you have? The first thing I want to look at is that. Is that positive? If it's not positive, you lose money every time you make a delivery, and you lose more money the more deliveries you make. So obviously we gotta look there first. So, structurally, that's the most important thing I look at. Is that in line with my industry? I actually don't know what it is for trucking, um, but in CPG or e-commerce, for example, it's like 20 cents for every dollar of revenue should be left over. Now, from there, we have to look at our fixed costs, right? So uh are we covering our leases, are we covering our staff? Are we covering offices? All those different things. And if we're not covering those, what you do next is you organize all your expenses into three buckets revenue generating, KTLO, which means keep the lights on, and other. And revenue generating costs, so let's say salesperson, if they're doing a good job or marketing or something like that, you keep those costs because they bring in the money, right? Yeah, KTLO is keep the lights on. So if you don't pay your truck lease, you don't have a truck, so you can't make the money anyway. So it doesn't generate revenue, or you could put it there too, but but so you have to keep the things that keep the lights on. Utilities. Um maybe you have enough trucks where you have a mechanic, and rather than paying a service, you have your own mechanic. Well, that guy or girl keeps the lights on the trucks moving, so you can't fire them. And so figure out what is the KTLO costs and be hard on yourself with these. Like literally really assess the owner's salary might not be KTLO, or the owner's wife, or mom or dad. Sometimes those might not be KTLO. You you pay them because you're a good person, but you have to be really strict about how you put these in these categories, and then other. Other is everything else, it's not those two things, and you just start gonna cutting other right, and it's hard to say and it's hard to do, and it's terrible, but start cutting other costs until you get to a point where you can grow the business and make some money.

SPEAKER_00:Yeah, reminds me of um you know, you're making a a meal for somebody. You you gotta really think about who's all coming. You want the head count, you want to think about well, uh, can we do we need all of that? You know, so you're like you're m making a recipe or a menu for people to enjoy or um for a banquet. And you know, you gotta make some decisions. Um, maybe you you want a lot of dessert, but you can't food, right? Totally. 100%. Yeah, so I mean, especially for trucking. Um, people say it's so hard to rent a trucking company um for you got to find a way to wash money. It's like, wow, I don't know. So many variables. But you the way you break it down makes it seem seem easy, easy to digest. That's nice. Um, so scaling and growth, a lot of owner operators want to add trucks, but uh they underestimate the financial impact. You know, you see the nice shiny trucks out there from from your experience. Uh, what hidden costs do people miss when they're scaling from maybe say if you were to take one to five trucks or up to ten? That is really the backbone of trucking, is those small companies like that. So what would you say to them?

SPEAKER_02:Oh man. Um, again, I go back to a a forecast. That's that's the foundation of everything that we do because you can just you can ask, you can, you can sort of uh assess multiple realities in a spreadsheet, right? And how does it look and how does it feel? And and so then what you said about missing things, I think the big one there is a realistic view on how fast growth will happen. Because I think for most business owners, the way that that I see things happening is they go, I'm gonna add this cost, truck, person, marketing, whatever. And we're gonna grow this much in this time frame and then we'll be fine. But I find that the growth takes longer to happen, typically, maybe not for some people, but most of the time the growth takes longer. And so they underestimate how long they have to bear an unprofitable truck for until it covers itself. That's what I see most often. Um and I think that more subcontracting probably can make sense to fill up a subcontract truck 75% or something, then buy your new one rather than buying a new one in advance, maybe. Um another one I see is you know and this is across industries too, is you want the newest, latest thing when an older one would do. So getting an older model is probably cheaper. Um and so again, I understand the desire for a nice thing, so it's hard for me to say anything about that, but like you know, sometimes you get the older one. Um and I think the other thing is most people underestimate the variable costs associated. So, what will fuel really be? What will the salaries really be? What will maintenance really be? And again, people have historicals and all that, but fuel is probably the one where it probably changes a bunch. And so just make sure that you go, okay, the truck should grow like this, it should do this, the people costs is that, the maintenance costs is this, and the fuel should be that. Well, what if fuel is 10% more or less or whatever? How does that affect your your your profit of that particular truck?

SPEAKER_00:Um I think that's what I would do. Yeah, that's what I would do there. Nice. Um what does a financial healthy trucking company look like or a company from any industry on paper? Should it even um maybe is there a number or percentage that they should look at um before expanding?

SPEAKER_02:Um you know, I wouldn't say there's any one number. Uh I what does a healthy company look like? I think a healthy company is profitable, typically, um, and has cash in the bank. So this is a tough one, but if you have three months of expenses in the bank, that's it's a pretty good place to be. It feels good. Okay. So so I would say that for me is is one. So you're you're making money, you're growing at a rate that makes you not want to pull your hair out, and you have cash in the bank to cover surprises. Um, and and from there, there's a wide range of what people are okay with. Like some some person might be okay with just three months in the bank and a little bit of margin, and they're gonna want to grow fast. Some people might want more margin, more cash, and they'll grow slower. I think both are okay. Um, but I think one big one is where the owner shouldn't feel super stressed all the time, right? Because if the owner is firefighting or is super stressed, they are gonna not they're not gonna think optimally, and they'll make mistakes because they're kind of off, you know. And so I think that again, the company should have cash and have margin, but the owner should feel good about it too. And if they don't, they're just bound to make bad decisions just because they're stressed and they're not thinking right. So, so I would think the ownership of a business should be healthy too.

SPEAKER_00:That's huge. I'm um to put those two together like that is great because when you think numbers, you don't think that emotion really comes in the factor, but it does.

SPEAKER_01:Yeah.

SPEAKER_00:Um, and you know, many truckers out there are gonna be struggling, not just with uh uh getting from A to B, but um financially, and that can affect a lot of people's decisions.

SPEAKER_02:Well, let me give you an example from from myself. So I have a I have a very good friend of mine, and they and he owns a business and I own a business, and and we're we're different because my wife is actually kind of okay with taking quite a bit of risk. So we have some loans and we've grown quite fast, and it's been a little crazy, and we can't do all the trips all the time, and sometimes it's stressful. And this other friend of mine, um, his wife is less okay with risk, meaning they have quite a bit of cash saved. And we we actually don't, um, because I'm putting in the business, but and they they have kept cash personally, and so they probably have well, I don't know how much, but a bunch of cash personally, but he's growing less fast. Um, but we all get along with our wives, and so we're happy, right? But I'm happy in a different way because my wife was a bit crazy like me, and he's happy because he's he's him and his wife have made whatever decisions on cash, but he's growing less slowly, but his relationship is good, and my relationship is good, but I can grow faster because my wife's crazy. Do you know what I mean? So that's even factors in like a prism effect, yeah.

SPEAKER_00:Yeah, I get that. All right, so and everybody's different, and like I like how you bring in the personal effect of it all because um everybody can't be like the other guy, you can't compare yourself to the next person, and um uh you definitely want to keep your wife happy or your partners. Yeah, 100%. Yeah, so man, so running trucks and finances require long haul, you know, patience. Do you see uh any results uh when it comes to personality of the people who start these companies? You know, maybe you've got to rub shoulders with a lot of people there, and when those people start those companies, they're in for the long game or um or the short term. I mean, what what is that like being around individuals that have this goal and they want to reach it? But it's it's like a long, long drawn-out plan. Yeah.

SPEAKER_02:Um, I got to see when I used to work in manufacturing, I got to see a bunch of trucking companies because we we did uh scrap metal, so they would bring us containers like I don't know, 20 a week and things like that. And so I got to see which companies were ended up doing well and and not. And I would say, from my perspective, the companies that ended up doing well, um they the ones that grew the most didn't always have the newest trucks for sure. Uh and these are short haul, so I don't know about the long haul side necessarily, but so they didn't always have the newest trucks. They had drivers that built relationships with us, you know. And so I think that if you can get people that build relationships with the people they're picking up stuff from or delivering stuff to, that made a difference. Um and so if you extrapolate what that means, I'm saying like they're conservative financially and they hire great people. Uh and I think if you can do those two things, you can decide do you want to be really aggressive with growth or not. But I would say, from my perspective, again, conservative financially and hire very good people. Uh you probably can't be stopped, to be honest. Because like if I like this guy who's bringing me the stuff all the time and he's just really nice, like I'm gonna call him back. You know what I mean? Uh and if the other guy's an asshole, well, maybe not, right?

SPEAKER_00:Yeah. That makes sense. Um long term, short term, you gotta start thinking bigger, you know, five year, ten year, fifteen years. Uh, who would people want to do business with more so? Uh someone that's you know not rude to them that treats them right, has good customer service, I guess it's gonna go a lot longer instead of that short-term transaction. So that's huge. Yeah. So think long term, that's a good thing that will help you financially. So if you were to sit down with a trucker today who has two trucks and dreams of owning the fleet, um, what's a single piece of financial advice you would want to give them so that when they walk away, they they'll feel like they're empowered.

SPEAKER_02:The single thing I gotta come back to is make uh make a forecast uh and and be conservative on it. And and if you want to do it for yourself, you just just make a spreadsheet and you go truck one, truck two, and expenses, and and just type them all in there. And I just want you to see profit or revenue minus expenses, and when you add a new truck, um add it conservatively so don't make it grow too fast, but add a new line, add a new truck, add the expenses for that truck, and just make sure that um that it that you know if you're gonna lose money on it for a little bit that you can withstand that, and if you can't, subcontract it. And I think if you do that, uh that's from my point of view, again, I'm a finance guy, so much from my point of view, that's the first most important thing to do.

SPEAKER_00:Nice. Yeah, the stuff that people don't want to look at, they just want to say, all right, I did good on that invoice. Yeah, we made a nice haul on that one. Um, so we should be out on on top, but yeah, actually sit down and and do some of the boring number crunching. Um totally boring.

SPEAKER_02:It'd be exciting for some people, but for some It is for me, but honestly, like we meet people once a month when we work with them, and I would say 10 of 12 meetings are just boring. Like just you go over the stuff and you're like, okay, I didn't learn much. But two meetings a year, and if you do this for yourself, two reviews a year, you're gonna find something important to help you make money or save money. But 10 of the 12 are gonna be boring, and but just do the work and it it'll get you there.

SPEAKER_00:Set some time uh in your schedule for doing the stuff that needs to be done. That'll keep you going, keep your dream alive, keep your um, keep yourself happy too emotionally, because then you got that, you're not just thinking about that. I hope we're okay. I hope we're okay. So exactly. All right, nice. Um, that's good advice. Uh, what is one thing you would like to share with people? Um, you know, I know that your company does really well. Um, what's one thing that they don't know that you would like to share with them? Possibly they know, hey, if I go to these guys, they're gonna take care of me.

SPEAKER_02:Um well, again, you know, we love spreadsheets, right? I have a team of 25 people, and one half of us are all in spreadsheets all the time. And so if you need some support, uh, we're here for you. And uh, if you don't want to make your own spreadsheets, my team will do it.

SPEAKER_00:So wow. I I can only imagine. So you gotta do all the graphs, uh, the charts, and all the um the commands, uh, what do they call those formulas? Yeah. Yeah, some pretty cool spreadsheets there.

SPEAKER_02:Yeah, we have we have we have some great ones. Uh yeah, we have some clients that just recently sold to a major market player, um, and and part of that process was building a fancy uh forecast for the acquirer. So yeah.

SPEAKER_00:Man, so when it comes to um artificial intelligence, AI, or whatever, um, what what do you see the future doing for that? Are you guys uh above the rest on that one, or how does it feel for you on the forecast?

SPEAKER_02:Yeah, so we're we're I would say on the advanced side, like we have our first AI employee doing things every day, all day right now. And it's uh it's a client coordinator. So uh we all we are as a consultant, we're on calls all the time. And so this employee uh listens to all of our calls and takes notes on action items and tries to understand like is the client happy or not happy, but then if it thinks it's unhappy, it'll flag our customer support team to talk to that client. And so we have our first AI employee. Um, I would say people should be all in, especially for truckers. I think um you could likely do prospecting with AI right now, so emails or even phone calls. Now you can do phone calls with AI for you know, hey, do you need deliveries? So on. Um, you could do your your reception, could probably be replaced by AI almost fully pretty soon. Uh, your admin, uh, a lot of that stuff, invoicing, follow-up, uh all a lot of the stuff could be done with AI, and then you'll save cost, right? Better margins. Um, I think it's we're quite a ways off from trucks that can do autonomous deliveries. So I wouldn't be stressed about that, but I would be thinking about it and trying to figure out what company is going to do it and how would you use it, and just be daydreaming about that. Um, because again, the first people to figure that out, again, your margins are gonna skyrocket, right? So um again, I think we're quite. Ways off, but but just be thinking about AI, be playing with it. You should have a ChatGPT on your phone. And if you drive yourself, you should be talking to Chat GPT when you're driving, just talking to the app. Um, and um you know, you ask it what you could do next, how you could use AI in trucking.

SPEAKER_00:Like that's that'll get you far far ahead of others. Yeah, the more comfortable you are with something, uh just like riding a bike or driving a truck, you know, um two different things, but you know, probably feel just as comfortable doing both. Um I know when I started riding the bike, I was pretty young. I loved I love riding around a bike, man. Yeah, so only fits that I love driving. Um, and then when I got in a semi truck, it was big, it was huge. I was like, I don't know if I could do this. Now it feels the same just like riding the bike. So yeah, you want to always be aware of dangers. But uh, I was I was kind of afraid of uh AI. I wonder where we'll go. And the more conversations I get to have with people, and um the more comfortable I feel about it. Um I think you know, going along the road of hey, where will this take me? Um, where do I see myself? It does spark the mind to imagine more things uh than you're you're capable of doing. So um it's nice to think on on a positive about it.

SPEAKER_02:Yeah, I mean I I I choose to be positive about AI. There's a lot of things you can be negative about, but I choose to be positive. I choose to believe in potential positive outcomes with AI. Um and you know, you you just can't know, so why not be positive?

SPEAKER_00:Yeah, we'll see see where it takes us. And I'm sure we're um as long as we're here to experience it, I think it's gonna be a uh a journey worth waiting for. So um, man, I really thank you for talking about what you guys do over there. I mean, um that forecast really sounds exciting when you when you look at it and get the numbers you want. So if it's if it's a lot of bad news, I bet you is a good way to get a reality check.

SPEAKER_02:True, right? Like sometimes you sometimes it is bad news. Like I had a client where we did their forecast, and I was like, in all three scenarios, you're losing money forever. But it allowed them to re-engineer the business model to fix it. So gave them power back.

SPEAKER_00:Gave them power back, exactly. Yeah. All right, man. Wow. Well, thanks, Matt. Uh, I think it's been an eye-opener. I think a lot of truckers out there, or even company owners. It may not be a trucker. Um, you may just be in the industry, come across a podcast. You know that that your company is one that will uh help them see things when it comes to wealth, stability, and their future. Um, so um I'm really appreciate you guys taking the time to do this. And uh thanks so much for having me, Ray. This is great. Uh anything else you wanted to share with people out there or let them know before we go?

SPEAKER_03:No, no.

SPEAKER_02:If you if you need to get in touch with us, my website is 8x.co e-i-g-h-c-x.co. And if you need some help, find us there.

SPEAKER_00:Awesome. And I'll put the links in the notes, and I appreciate that, man. So for those who want to learn more, uh, please reach out to Matt and his team. Uh, we really thank you guys for joining us. And uh to everyone listening, please remember trucking isn't always just about running freight, it's about building something that will last and stand the test of time. So um get those numbers right, and uh we can see you in the right areas where you need to make the decisions to make your business grow. So I'm trucking Ray, and that's delivered.

Podcasts we love

Check out these other fine podcasts recommended by us, not an algorithm.

Channel 19 Experience Trucker Podcast

Channel 19 Experience

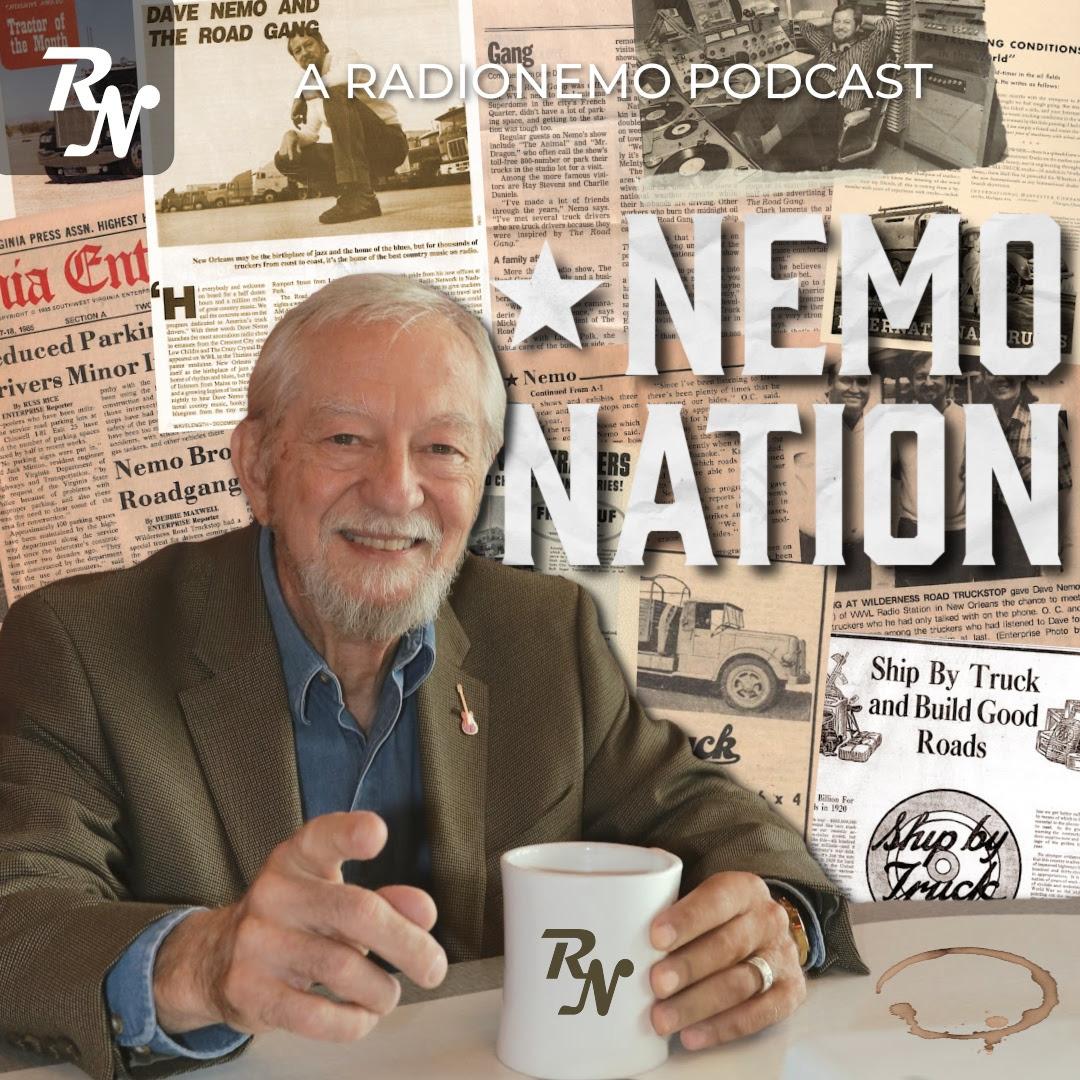

Nemo Nation

Nemo Nation

The Lombard Trucking Show

Michael Lombard